How to Improve Your Finance Skills (Even If You Hate Numbers)

If you’re not a numbers person, finance is a daunting subject. But understanding concepts like EBITDA and net present value are important no matter where you sit on the org chart. Here are some strategies for boosting your financial acumen. Get acquainted with your company’s income statement. Reproduce the numbers in a spreadsheet then group them into categories of profit and loss. Your goal is to understand how much your company spends and where it makes money. Play with the numbers. Experiment with the figures on the balance sheet by going through a series of “what if” scenarios. What if prices were lower? What if revenue was higher? This exercise helps you internalize how financial models work. Find a financial mentor. Foster a relationship with a senior financial or operations manager who can teach you and answer your questions. This person can also serve as a sounding board for financial decisions you need to make.

If you’re not a numbers person, finance is daunting. But having a grasp of terms like EBITDA and net present value are important no matter where you sit on the org chart. How can you boost your financial acumen? How do you decide which concepts are most important to understand to your work and your understanding of the business? And who’s in the best position to offer advice?

What the Experts Say

Even if you don’t need to know a lot about finance to do your day-to-day job, the more conversant you are on the subject, the better off you’ll be, according to Richard Ruback, a professor at Harvard Business School and the coauthor of the HBR Guide to Buying a Small Business. “If you can speak the language of money, you will be more successful,” he says. After all, if you’re trying to sell a product or strategy, you need to be able to demonstrate that it is both practical and high margin. “The decision-makers will want to see a simple model that shows revenue, costs, overhead, and cash flow,” he says. “They need to see why it’s a good idea.” Joe Knight, a partner and senior consultant at the Business Literacy Institute and the coauthor of Financial Intelligence, says that an absence of financial savvy is “career-limiting.” If you’re unable to contribute to a discussion on the company’s performance, you’re unlikely to advance. “You are not going to be involved in running projects unless you understand the financials,” he says. Here are some strategies to improve your financial intelligence.

Overcome your fears

Stop avoiding finance because you’re afraid of numbers. It’s not rocket science, says Ruback. Think of it this way, “Finance is the way businesses keep score. It’s like counting balls and strikes in baseball,” but instead you’re “measuring progress through financial performance,” he says. “It’s not that complicated.” Besides, the math is easier than you might think, says Knight. “Finance and accounting are very simple. It’s mostly addition and subtraction and occasionally some multiplication and division,” he says. “There’s no magic.”

Learn the lingo

There may not be any magic to finance, but there is a fair amount of jargon. Fortunately, there are many ways to learn the terminology, says Knight. You “just need to take initiative,” he says. If your company offers internal finance training, take advantage of it. If it doesn’t, consider enrolling in an online or community college class. Of course, there are also myriad books and reference guides on the topic. The most important concepts to grasp are “how to measure profitability, EBITDA, operating income, revenue, and operating expenses,” he says. A finance textbook or reference guide is a good investment; but “Google works too,” he says.

Tackle the balance sheet

Next, says Knight, you need to immerse yourself in your organization’s income statements. “Take an interest in the balance sheet and then do the due diligence to understand it,” he says. The best way to learn, says Ruback, is to “reproduce the numbers” either electronically or on a sheet of paper and then “group them into categories so you can start to see how much your company spends and where it makes money,” he says. Convert the numbers to percentages so you more easily visualize the breakdown of revenue and expenditures. “You want to see the big picture.”

Focus on key metrics

Boosting your financial expertise requires figuring out the metrics by which your company measures success. Your goal is to develop a deep understanding of the precise “link between profit and loss” and how that affects your organization’s performance over time, says Knight. That metric is often expressed in the form of a ratio. “There are four ratios common in every company: profitability, leverage, liquidity, and operational efficiency,” he says. And every organization has “two or three ratios within” those groups that are considered its primary measures of performance, in addition to “industry-specific ratios.” Paying closer attention to your company’s balance sheet and “listening to your company’s quarterly earnings calls” is helpful in getting a handle on these metrics. “They’re not hard to calculate. It just takes effort,” he says.

Play with numbers

Once you have a solid understanding of the balance sheet and what drives your company’s growth, try “experimenting and playing with the numbers” by going through a “series of ‘what if?’ scenarios,” says Ruback. For instance, What if prices were lower? What if revenue was higher? What if costs go down or up? “You’re not managing specific business decisions, you’re trying to understand and internalize how the models work” and the assumptions they make. That way, when you do need to “tabulate the consequence of a particular decision,” such as, whether or not to launch a new product or shut down a factory, you have the tools to do so. “People think budgets are static. But in most instances, you run the models to figure out what’s important and how much room there is for error.”

Find a financial mentor

Connecting with a “senior financial or operations manager” who can “teach you,” and “answer your questions one-on-one” is another way to get better at finance, says Knight. “It’s a very natural way to learn,” he adds. Ruback agrees. “Mentors are always helpful for someone who is not good with numbers,” he says. This person can both help explain concepts and serve as a sounding board for any financial decisions you need to make. Ruback suggests asking your colleague “to try to replicate” your projections and models when needed. “It sharpens your focus,” he says. “You find that Jane made certain assumptions, while you made others. One is not right and the other is not wrong, but [the differences] help you figure out what’s reasonable.”

Make it personal

Still lacking motivation? Make improving your financial skills “a survival issue,” says Knight. “Every time you are paid, your organization makes less profit. So you need to think about what you can do to help the company remain profitable or be more so.” The goal is to develop an understanding of how your day-to-day actions help your employer to “drive revenue or mitigate costs,” he says. “Think of yourself as a miniature profit and loss statement: How do you add value?” This can be a useful exercise, but don’t let it consume you, says Ruback. After all, it’s easier to determine your impact on the bottom line if you’re in sales, but it’s not as straightforward if you’re in, say, HR. “Integrate your role with the contributions of others,” he says, “and focus on the problems you can control, not the ones you can’t.”

Principles to Remember

Do:

Don’t:

Case Study #1: Partner with a colleague in finance and experiment with numbers

Larry Dunivan, the chief revenue officer at Ceridian, firmly believes, “All leaders should be able to talk about the numbers in a broad and sophisticated way.”

But Larry admits he wasn’t always able to do that. Earlier in his career, he worked as a product manager at a software company. As an MBA student at Northwestern’s Kellogg School of Management, he had taken basic finance courses and his skills were a good fit for the job. “I managed costs and supported the general business activities associated with the

-

“Sqribble.com”, World #1 Greatest Content Articles & Ebooks To Create Effective Content For Your Website!

-

93% of people don’t know this truth about their zodiac sign. Do you? video.callofdestiny.org

-

Activate Success – Thebillionairebrainwaves.com: The Billionaire Brain Wave Works! Get Over $10,997 Premium Bonuses with thebillionairebrainwaves.com

-

Balmorexs.com| Relieve Joint and Muscle Pain Fast with Balmorex Pro

-

Balmorexs.com| With Balmorex Pro, Reduce Joint and Muscle Pain Quickly, Here Great Over $10,997 Bonuses

-

Bazoprils.com Maintains Healthy BP, Heart & Kidney Today with Great Over $10,997 Bonuses | Bazopril’s Super Nutrients

-

Bazoprils.com| Maintain Healthy BP, Heart & Kidney with Bazopril’s Super Nutrients

-

Blue-heron-health-news-Cure-Arthritis| Do’s and Don’ts for Relief To Treat All Types Of Arthritis In 3 Easy Steps!

-

Blueheronhealthnews.com – Three approaches to overcoming fatty liver disease ; Today with Great Over $10,997

-

Blueheronhealthnews.com, hypothyroidism, Say Goodbye to Hypothyroidism Forever

-

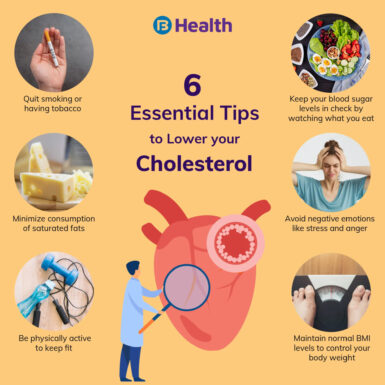

Blueheronhealthnews.com, Secret Ingredient | Lowers Cholesterol, Plaque, Clears Arteries!

-

Bringing Old Dead Batteries Back To Life in Minutes! Ezbatteryreconditionings.com | Here Included Over 19,541 have Saved them thousands of dollars.

-

Bringing Old Dead Batteries Back To Life in Minutes! Over 19,541 have Saved thousands of dollars | ezbatteryreconditionings.com.

-

Bringing Old Dead Batteries Back To Life in Minutes! Over 19,541 have Saved thousands of dollars | ezbatteryreconditionings.com.

-

Children Learning Reading – Amazing Successful Reading Program Parents Love!

-

Children Learning Reading – Amazing Successful Reading Program Parents Love! childrenlearningreading.com $10,997 Premium Bonuses

-

Children Learning Reading – Amazing Successful Reading Program Parents Love! childrenlearningreading.com $10,997 Premium Bonuses

-

ClickEarners.com |Get Paid to Work Remotely as a Virtual Online Assistant Today!

-

Exfactorguide.com| Win Her Heart Again: Effective Breakup Solutions For Men and Women!

-

Forwardheadposturefix| Forward Head Posture FIX in 15 Minutes a Day!

-

FREE Traffic To Your Sites Every Day In Just Minutes ; Fergalscoaching.com, Get Great Over $10,997 Premium Bonuses

-

Getorganizednow.com | Get Organized Now! | The Ultimate Guide to Launching a Profitable Professional Organizing Business Immediately, Complete with Over $10,997 in Bonuses!

-

Go.smoothiediet.com – Lose Weight Fast: 21-Day Smoothie Diet Transformation!

-

Homedoctorguide.com| Survivor this Crisis: Signals a Heart Attack, Today with Great Over $10,997 in Bonuses! Also What you had to do After? ;

-

How to Restore Your Vision Effectively, Naturally with TheyaVue! gettheyavue.com – Also Great Over $10,997 Premium Bonuses

-

Neurobalancetherapy.org – Improve Balance & Stability Today with Great Over $10,997 Bonuses | Neuro Balance Therapy.

-

neurobalancetherapy.org| Improve Balance & Stability with Neuro Balance Therapy

-

Neurothrive.org| Improve Your Memory: Tried-and-True Techniques and Plans Available Now with Huge Bonuses of Over $10,997

-

neurothrive.org| Transform Your Memory: Proven Methods and Strategies

-

paidonlinewritingjobs.com |Write Reviews and Earn Weekly Start Your Writing Job Today!

-

Paidonlinewritingjobs.com| Start Your High Demand Writing Career Instantly, Today with Great Over $10,997 in Bonuses! Simply Write Reviews and Earn Weekly!

-

Pmmilestone.com| Securely ImprovesEfficient and Effective Project Management For Your Business?

-

Prevent Dizziness Try at claritox.com fo Claritox Pro com for Balance! Claritox-com Here Great Over $10,997 Bonuses

-

Prevent Dizziness: Try Claritox Pro for Balance! Claritox-com Here Great Over $10,997 Bonuses

-

Profitmasterkey.com, Are You Good At Building Email Lists Of Your Ideal Prospects? Here Over $10,997 Premium Bonuses

-

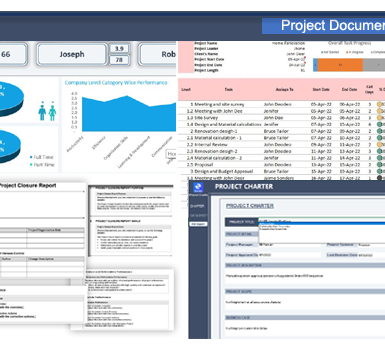

Project Management Templates – ucube.com | “Streamline Projects: High-Quality PM Documents Included”

-

Quietumpluss.com| Revitalize Ear Health with Quietum Plus Formula

-

Referral Agent Secrets – Increase Six Figures income with your real estate license!

-

Restore Your Vision Naturally with TheyaVue gettheyavue.com! Get Also Great Over $10,997 Premium Bonuses

-

Selfsufficientbackyards.com – Self Sufficient Backyard |The Only Secrets Book You Need to Become Self Sufficient on ¼ Acre With $10,997 Bonuses!

-

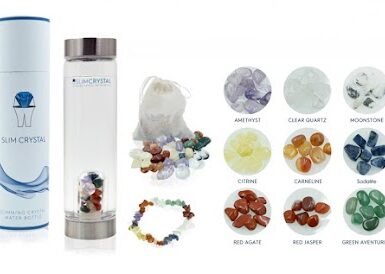

Slimcrystal.com | Boost Energy & Shed Pounds Today with Great Over $10,997 Bonuses |SLIMCRYSTAL.com Bottles

-

slimcrystal.com| Boost Energy & Shed Pounds with SLIMCRYSTAL Bottles

-

Survive Any Crisis: How to Recognize a Heart Attack and What to Do Next ; homedoctorguide.com. Great Over $10,997 Bonuses

-

Synogut101.com – Revitalize Your Digestion Naturally with Synogut with Over $10,997 Premium Bonuses!

-

Tedplansdiy.com | 16,000 Woodworking Plans: Build Anything Easily! Get Highest Over $10,997 Premium Bonuses

-

The Click Wealth System – Build a Profitable Online Business in 4 Easy Steps! Get Over $10,997 Bonuses

-

The Click Wealth System – Build a Profitable Online Business in 4 Easy Steps! Get Over $10,997 Bonuses

-

The Tupi Tea Secret For Stamina & Virility | Gettupitea.com, Over $10,997 Premium Bonuses

-

The Ultimate Guide for Launching a Professional Profitable Organizing Business Today, getorganizednow.com, With Over $10,997 Bonuses!

-

Ultimate Myprodentim.com – Say Goodbye to Dental Issues with Myprodentim.com Unique Formula!

-

Unlock & Transform Your Wealth with the 5,000-Year-Old the Ancient Secret to Effortless Wealth!

-

Unlock Deep Sleep Secrets for Weight Loss & Anti-Aging Youth & $10,997 Bonuses – Saltwatertrick.com | Renew-nightly-com

-

Vip Indicators – Win 93% of Trades with VIP Trading Indicators! vipindicators.com, Over $10,997 Premium Bonuses

-

Wealthdnacodes.com| Unlock Effortless Wealth with the Wealth DNA Code With Great Over $10,997 Bonuses!

-

WoodProfits.com – Start Making Money with Home Woodworking Today! Get Over $10,997 Premium Bonuses

-

Write Reviews and Earn Weekly ? Start Your Writing Job Today!

-

Writeappreviews.com – Get Paid Easily by Testing & Review Apps For Businesses! Over $10,997 Premium Bonuses

-

www.exfactorguide.com |Proven Secrets Will Get Your Ex Back, Promised Here Great Over $10,997 Bonuses

-

www.ezbatteryreconditioning.com, Top Business Systems And Get The Greatest Premium Bonuses of Over $10,997 at www.ezbatteryreconditioning.com/

-

www.Geniuswaveoriginal.com |The Ulitmate Genius Wave Audio Track to Unlock a Better, Here Great Over $10,997 Bonuses, Life of Health and Happiness

-

www.PMMileStone.com | Top Business Systems www.pmmilestone.com And Get Highest Over $10,997 Premium Bonuses

-

www.ucube.com, Top Business Systems www.ucube.com And Get Highest Over $10,997 Premium Bonuses

-

www.WoodProfit.com, Top Business Systems www.WoodProfit.com And Get Highest Over $10,997 Premium Bonuses

-

Zencortex24.com| Discover ZenCortex: Optimize Your Hearing Today with Great Over $10,997

-

Zencortex24.com| Discover ZenCortex: Optimize Your Hearing Today!

But, when he got promoted to work in a mergers and acquisitions role at the company, he felt in over his head. “Suddenly I needed to know things like EBITDA and how enterprise value was determined,” he says. “It was trial by fire, and I remember thinking, ‘How can I not look like a fool in this meeting?’”

He needed help. Fortunately, Larry had a good relationship with a peer — “Rick” — in the finance department. Rick’s job was to build the financial models that would inform strategic decisions about potential M&A activity. Rick was always willing to detail how the models worked and answer questions. “He was very patient and knowledgeable,” Larry recalls.

He was soon comfortable enough to start collaborating with Rick. “I’d say to him, ‘Show me the variables that have the most sensitivity,’ and then I would test different assumptions,” he says. “I still didn’t know how to do the underlying computation to create the model, but I had a solid understanding of the assumptions that went into it.

Larry says that Rick’s help and support was invaluable in improving his financial acumen. “A great partnership with a finance colleague will take you a long way,” he says.

Case Study #2: Learn the metrics your company uses to measure success

James Pieper, the chief accounting officer at TransUnion, the consumer credit reporting agency, says it’s “critical” for employees to have a “basic understanding of finance so they know how their company is doing financially.

“The great thing about accounting and finance is that it’s universal, so once you have the foundation you can go from there,” he says.

At the same time, James is well aware that each company monitors performance in its own way. James spent most of his career at publicly traded companies. But when he first arrived at Chicago-based TransUnion in 2014, a private equity group owned it. “So I had to learn which financial metrics mattered, why they were important, and how TransUnion measured success,” he recalls.

He did a lot of the initial learning and number crunching on his own. “Luckily in my position I have access to every number, so I rolled up my sleeves with an Excel spreadsheet and tried to re-create the statement,” he explains. “I spent time validating the numbers to make sure they made sense.”

He also sought guidance from a “finance buddy,” who at the time was a peer in the accounting department. “He’d been at the company for a while and he helped me understand the details of the calculations,” he says.

In 2015, TransUnion went public, and James had to help the company manage this financial transition. To boost his skills and knowledge, he looked carefully at the balance sheets of the company’s “25 closest peers to understand how they structure their earnings releases and what they put forth as their main financial metrics.”

James often leads in-house financial training sessions for his company. He says it encourages colleagues to “understand where they fit in the big picture” of TransUnion’s finances. “I don’t drive revenue — I am an expense,” he says. “As part of the cost basis, I try to make my organization run as efficiently as possible.”

Rebecca Knight is a freelance journalist in Boston and a lecturer at Wesleyan University. Her work has been published in The New York Times, USA Today, and The Financial Times.

How to Improve Your Finance Skills (Even If You Hate Numbers)

Research & References of How to Improve Your Finance Skills (Even If You Hate Numbers)|A&C Accounting And Tax Services

Source

0 Comments